VCU Reporting Center job aid

This Job Aid is designed to help business users understand the various financial reports that are provided through the VCU Reporting Center. These reports are designed to help fiscal administrators, financial, business and operation managers perform their daily tasks with greater efficiency.

In this Job Aid, you will find specific information about financial reports and resources available to business users. These resources can be accessed through VCU Reporting Center. Standard ad-hoc financial reports are stored in a folder name Finance. Two business intelligence dashboards are also available: The Research Dashboard and the Finance Dashboard.

Log in to the VCU Reporting Center here (you must be connected to the RamsVPN to access)

Alternatively, log onto the myVCU Portal and click on “VCU Reporting Center” under General Resources.

Watch a video on how to navigate the VCU Reporting Center (hosted by VCU Kaltura)

Research Dashboard access

Access to the Research Dashboard in the VCU Reporting Center is currently maintained by the University Controller's Office.

PI Dashboard: Principal Investigators are automatically given access to the PI Dashboard when their grants become active in Banner Finance.

RA Dashboard or Research Management Dashboard: Research Administrators or Department Deans/Directors can request access to the Research Administrator (RA) Dashboard or Research Management Dashboard by submitting a ticket through the RamCentral Ticket Portal:

- Click here to access the Banner Finance Dashboard Support form (must select IT Portal),

- Select Access Request from the Request Type Drop down,

- Fill out all required fields,

- Describe your role as either Research Administrator or Department Dean/Director and specify the sub-department, department or school to include in your view. Click Review. & Submit.

You will be notified when your access is complete. The first time you access the RA or Research Management Dashboard, you may need to clear the page caching on the VCU Reporting Center to see the relevant tabs. Follow these instructions:

- Log in to the VCU Reporting Center (through MyVCU)

- Select Options (from upper right-hand menu)>Tools>Manage Page History>Clear History

- Watch a Video on how Research Administrators use the Research Dashboard

Finance Dashboard access

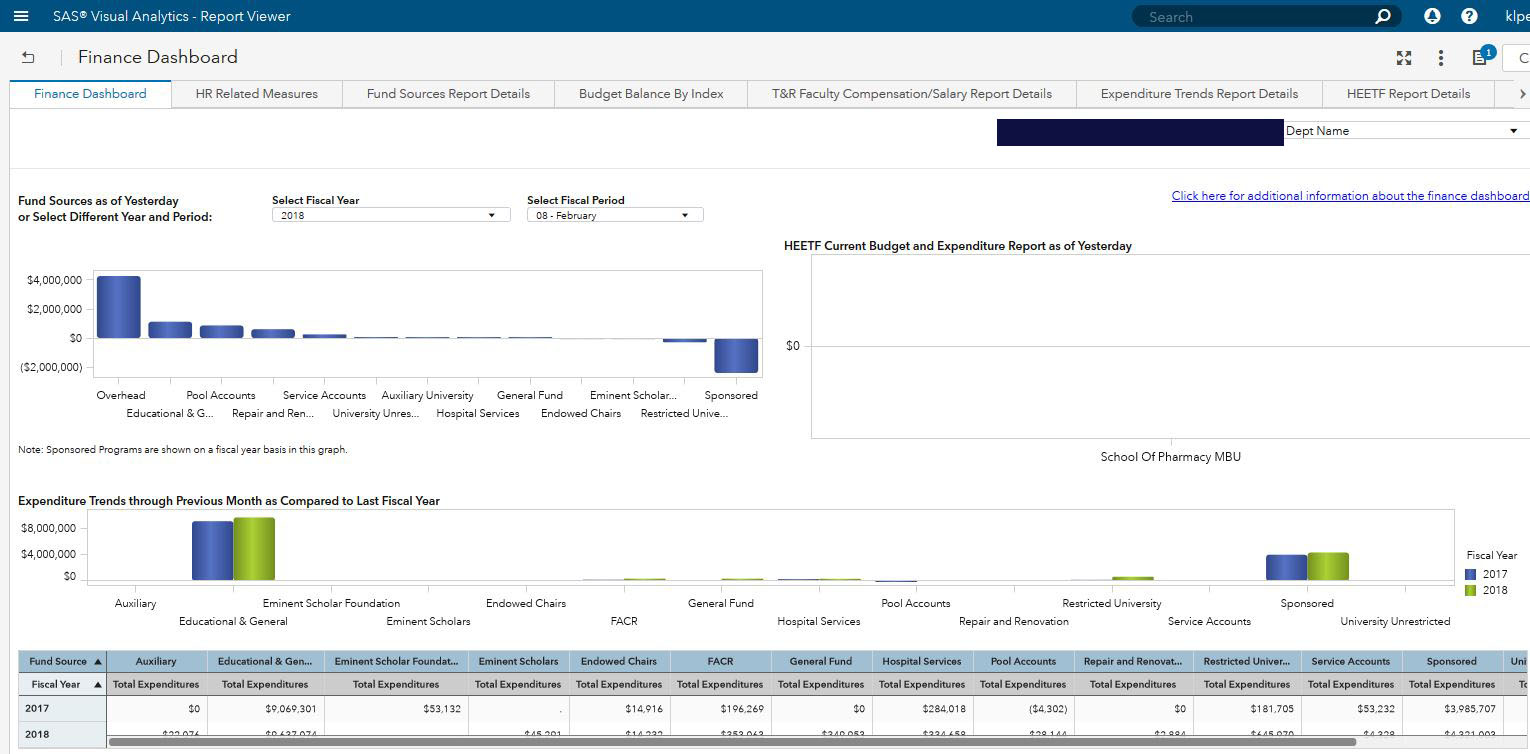

The Finance Dashboard is available to VPs, Deans, Chairs, Department Heads and Fiscal Administrators. The Dashboard presents an overall financial picture of each organization. It includes:

Fund Summary: Balance available by each fund type (E&G, Sponsored, Overhead, Auxiliary, etc). The Balance available is determined by Budget minus expenses-encumbrances and it is summarized by the department level.

HR Related Measures: Measures for teaching and research faculty average salary by rank, faculty rank as a percentage of total faculty compensation, list of current faculty and their rank and base salary as well as demographic measures for faculty and non-faculty.

Budget Balance by Index: Gives the most current budget balance available by index (organization code).

Expenditure Trends: Compares the expenditure trends for this fiscal year compared to last fiscal year by fund type.

Monthly Expense Reports: Monthly expense reports for each index within an organization level. It does not include Sponsored Program indexes as they are part of the Research Dashboard. The reports are available to review within the dashboard or available in a pdf file to download. Department chairs and fiscal administrators can "opt-in" to use the Finance Dashboard to certify their monthly reconciliations online.

Access to the dashboard is assigned by role (Dean level, department head level, fiscal administrator, fiscal staff, etc.) and by Banner organizational units (MBUs, Departments and Sub-departments).

Access to the Finance Dashboard can be obtained by submitting a ticket through the Cherwell Ticket Portal:

- Log in to itsupport.vcu.edu

- Navigate Service Catalog → Accounts & Access → University Administrative Resources → Banner Finance

- Request Finance Dashboard

- Please include the organizational level needed and your role within that organizational level- For examples, (Dean level, department head level, fiscal administrator, fiscal staff, etc.) and by Banner organizational units (MBUs, Departments and Sub-departments).

- Click Submit.

The first time you access the Finance Dashboard, you may need to clear the browser cache on the VCU Reporting Center to see the relevant tab. Follow these instructions:

- Log in to the VCU Reporting Center (through MyVCU)

- Select Options (from upper right-hand menu)>Manage Page History>Clear History

Watch a video about the Finance Dashboard (hosted by VCU Kaltura)

Reports and resources

Most reports contain a prompt page that allows the user to customize the report output by selecting a few report parameters such as organization code, fiscal year and fiscal period. Standard reports have the output options of HTML or EXCEL formats.

The organizational level codes are commonly used for selecting specific criteria for financial reports. The Input columns on example tables below display the field codes that are entered as reporting criteria before the reports are run. Complexity of criteria selection vary among reports.

It should be noted that, VCU ODS (Operational Data Store) gets updated every night, as a result, the reports that are run during business hours do not reflect real-time production Banner (most current data). The data that is retrieved by these reports are current through the previous business day's transactions.

Fiscal Year: Unless otherwise stated on the report, all fiscal year entries must be made in the form of four digit (YYYY) year. Ex: 2008

Fiscal Period / Posting Period: All fiscal period or posting period entries must be made in the form of two digit (MM) month. Ex: 08 for February

It should be taken into account that the fiscal year at VCU starts on July 1st and ends on June 30th of each year. Two digit numeric representation of each month as follows:

Input /Description

01 - July

02 - August

03 - September

04 - October

05 - November

06 - December

07 - January

08 - February

09 - March

10 - April

11 - May

12 - June

13 - Adjustments

14 - Adjustments

Organizational Level Codes: These codes will help business users to determine the scope of the reports. Organizational hierarchy and associated organizational code structure must be known and entered to utilize most of the financial reports. Tables below are examples for the organizational level codes. The full list of these codes can be obtained by using the report called Chart of Accounts. This report is located under the finance folder of VCU Reporting Center and can be accessed via VCU portal. Organizational hierarchy values can also be obtained by using Banner forms FTIORGH (for orgs) and FTIFNDH (for funds).

Organizational Level Codes - Example Purposes Only!

Executive Level Codes

Input /Description

A - President

B - Provost & VP of Academic Affairs

C - VP Health Sciences

D - SVP Finance & Administration

E - VP Advancement

E - Central Accounts

G - VP Research

H - VP Government Relations

J - VP External Relations

Senior Mgmt. Level Codes

Input /Description

11 - President

12 - Provost

13 - Student Affairs

14 - VP Research

15 - VP External Relations

16 - VP Health Sciences

17 - Executive Director VCUHSA

19 - SVP Finance & Administration

20 - AVP Buss. Serv. Treasurer

21 - Human Resources

22 - Facilities Management

23 - AVP Finance & Administration

MBU Level Codes

Input /Description

101 - Office of President

102 - Board of Visitors

103 - Legal Affairs

104 - Athletics

105 - SVP Finance & Administration

106 - Audit

107 - AVP Buss. Serv. & Treasurer

108 - AVP Finance & Administration

109 - University Controller

110 - Procurement Operations

Auxiliary Enterprises Budget Comparison Report

Auxiliary Enterprises are accounting entities that provide goods or services primarily to students, faculty, staff, and others and charge a fee directly related to, although not necessarily equal to, the costs of the goods or services. The distinguishing characteristic of auxiliary enterprises is that they are managed essentially as, and intended to be, a self-supporting activity. Examples of auxiliary enterprises include residence halls, dining halls, and bookstores. VCU groups the Auxiliary Enterprises in fifteen (15) distinct categories. These categories are:

- Auxiliary Enterprises - Faculty / Staff

- Auxiliary Enterprises - Student

- Food Services

- Gymnasiums

- Intercollegiate Athletics

- Larrick Student Center

- Operation and Maintenance of Plant

- Parking and Transportation

- Residential Facilities

- Stores and Shops

- Student Activities

- Student Health Services

- Telecommunications

- Vending

- Other Auxiliary Enterprises

For each of the categories above, Auxiliary Enterprises Budget Comparison Report compares budget to actual revenues and expenditures for the selected fiscal year and fiscal period.

Budget Expenditures Detail Report

This report is designed to provide detail budget expenditure information concerning Adopted, Original, Temporary and Total budgets as of a given date. Adopted Budget is defined as the budget that is given to the organizational entity at the beginning of each fiscal year by the budget office. Original budget is the revised version of the adopted budget after permanent budget adjustments (plus or minus) are made. Temporary Budget is the current year expendable budget. In order to run this report, fiscal year, as of date, fund type (budget program category) and an organization level should be entered as required reporting criteria. Based on business user's security clearance he/she can run this report at any organizational level in the hierarchy, such as University, Executive, Senior Management, MBU...etc.

Budget Revenues Detail Report

Budget Revenues Detail Report is designed to provide detail budget revenue information concerning Adopted, Original, Temporary and Total budgets as of a given date. Adopted Budget is defined as the budget that is assigned to the organizational entity at the beginning of each fiscal year by the budget office. Original budget is the revised version of adopted budget after permanent budget adjustments are made. Temporary Budget is the current year expendable budget. In order to run this report, fiscal year, as of date, fund type (budget program category) and an organization level should be entered as required reporting criteria. Based on business user's security clearance he/she can run this report at any organizational level in the hierarchy, such as University, Executive, Senior Management, MBU...etc.

Current Budget Transactions

This report provides detailed information on all original, permanent and temporary budget transactions for a given program (educational and general, FACR or auxiliary). Report results are filtered by MBU, department, sub-department or organization and transaction beginning and ending dates are specified by the user.

Permanent Budget Transactions

This report provides detailed information on transactions that affect permanent budget for a given program (educational and general, FACR or auxiliary). Report results are filtered by MBU, department, sub-department or organization and transaction beginning and ending dates are specified by the user.

Departmental Detail Budget Status

This report gives detailed budget vs. expenditures data by the account level. The user will need to provide the fiscal year, year to date fiscal period and org code. The org code field ranges from the org code (index) level to the MBU level. Users will need to know the codes for this field as no drop-down menu is provided.

Budget vs. Actual Summary

This report gives detailed budget vs. expenditures data by summarized account levels (personnel, expenditures). It includes the permanent budget, adjusted budget, sum YTD expenses, encumbrances and balance. It also includes the fund type (E&G, Overhead, Sponsored, etc.) and the program (Instruction, Institutional Support,etc.). It can be run by all organizational levels and for all funds or for a specific fund.

FGRBDSC- Budget Status Fiscal Period

This report is similar to the canned reports in ePrint. It is a standard budget report for all indexes (org codes) or a specific index. It can be run by MBU, Department, subdepartment or by individual index number.

FACR Accumulated by Grant Fund

In this report, FACR (Facilities and Administrative Cost Recoveries) expenditures are shown for the current period (monthly) and fiscal year to date period. In Banner, these expenditures are reported in expenditure account 639997 and represent administrative overhead and other support costs associated with research grants. Other information provided in this report includes: department, sub-department, organization code, grant ID and title, G and C accountant and principal investigator.

Parameters for the report include options for the fiscal year and fiscal period. Hierarchy level parameters include: executive level (vice presidential level), senior management level, major budget unit, department or sub-department.

G and C Grant Billing Drawdowns

G and C Grant Billing Drawdowns is a transaction detail report that identifies transactions that may not be allowable on certain grants. Fiscal administrators should review the output to determine whether the charges are allowable with the terms of the grantor. This report contains detailed information for each transaction including: document number, activity date, rule class and description, amount of transaction, G and C accountant, grant ID, fund and organization code.

Parameters for the report include options for fiscal year and a fiscal period range (starting fiscal period and ending fiscal period) by hierarchy level. Hierarchy level includes department, sub-department or organization code.

Grants Budget and PTD Actual

Report shows grant budget and project-to-date actual expenses for direct and indirect cost. It shows project start and end dates, general grant information (including P.I.) and can be run for ARRA, non ARRA or all awards.

Parameters include fiscal year, fiscal period and hierarchy levels that include University executive level (vice presidential level), senior management level, major budget unit level, department or subdepartment level.

Grant Deficit Report

Grant Deficit Report by grant ID and fund are reported by fiscal year and period (month). By using the selected parameters, deficit balances can be shown by: fiscal administrator, principal investigator, G and C accountant, sub-department, department, major budget unit or senior management level.

Report fields provide information for G and C accountant, principal investigator, fiscal administrator, months in deficit, grant end date and sponsor.

There are two versions of this report available, one for industry clinial trials and one that excludes clinical trials.

Grant Expenditures Report

Grant Expenditures is a summary report for total expenditures by grant organization code. This report has selection criteria for fiscal year and fiscal period along with hierarchy selection by major budget unit, department and sub-department.

Expenditures are reported as total year to date expenditures for Stimulus and Non-Stimulus awards, total year to date direct cost and total year to date indirect cost. Direct cost does not include FACR (overhead or indirect costs). Indirect cost is the amount of FACR charged to the research grant. Other report fields include Grant ID, Grant and Grant Description.

Grant ID Project Start and End Dates

Grant ID Project Start and End Dates offers project start and end dates by grant ID with fund balance (budget minus YTD activity for expenditures). Parameters include: fiscal year and period, major budget unit, department, sub-department and fund status. Report fields include: project start and end date, grant ID, principal investigator, G and C accountant, fund code, fund description, department, department description, sub-department and fund balance.

Grants and Principal Investigators

This report identifies the principal investigator associated with a Grant ID. Hierarchy selection includes major budget unit, department, or sub-department. The selection criteria includes results for grants that are active, inactive or both.

The report fields include: grant ID and title, G and C accountant, principal investigator, department, sub-department, fund indirect cost distribution code (distribution percentage indicator on grant fund), fund code and description.

It should be noted that on this report, business users will only see fund codes for Grant IDs assigned to their department or major budget unit. They may not be able to see multi-disciplinary grants.

Grant ID Crosswalk

Grant ID Crosswalk provides information on what funds and organization codes are associated with each Grant ID. Parameters include: organization code, department, sub-department and grant status.

Report fields include: major budget unit, department, sub-department, grant ID and title, G and C accountant, fund type and description, fund, organization code and description.

Indirect Cost Expense Report

The Indirect Cost Expense Report provides information on the automatic entries for indirect cost that are created in the Banner Finance System. This report provides detailed information for the associated grants and expenditures used for the calculation, as well as the organizations used to recover revenues. The report parameters include start and end dates and department or sub-department values. Please note that manual entries for indirect cost will not be reflected on this report.

Indirect Cost for New Grants

Indirect Cost for New Grants identifies indirect cost information associated with new grants. This report contains: grant ID, fund, G&C accountant, principal investigator, budget period end and start date. Indirect cost rate, basis, charge account code and distribute to code are included. Report parameters are budget period start date and hierarchy level options for MBU, department and subdepartment.

Indirect Cost Revenue Report

This report provides the revenue generated through indirect cost by grant ID. It does not include the expense detail. The report parameters include start and end dates and department or subdepartment values. Please note that manual entries for indirect cost will not be reflected on this report.

Responsible Organization Grant Monitoring Report with Labor

This report allows you to see the detail charges, including payroll, for all sub-accounts even if that sub-account is in another department. A sample of the report is attached. The "V" numbers and employee names have been removed from the sample, but they will display when you run the report. The report parameters are responsible org code, fiscal year, transaction start and end date and whether to display in Excel or HTML.

Transaction Detail- Grants

This report is designed to provide detail transaction information for grants in a given fiscal period for all organizations. Transactions are presented by grant ID description, amounts, associated rule class and document information, related organization code, organization description, and account and account description. Business users may run this report at three different organization levels: department, sub-department, and organization code.

Fiscal year, fiscal period(s), preferred organization level and range for associated accounts (to see whether the transaction is associated with an expenditure, revenue or personnel costs accounts) are necessary parameters to run this report.

Chart of Accounts Report

The Chart of Accounts is the numbering system used by Banner to capture financial transactions and facilitate retrieval of information and financial reporting.

The Chart of Accounts structure is composed of six elements: Fund, Organization, Account, Program, Activity, and Location (FOAPAL). Activity is currently not used at VCU.

The Chart of Accounts Detail report is designed to help business users understand the organizational hierarchy and the relationship among the organizational levels within this hierarchy. It also provides related fund and program information associated with all organizational levels. Based on their security clearance within the organization, business users can utilize this report at various levels. These levels are executive, senior management, major budget unit and department. Although the sub-department and organization levels are not given as options in the reporting parameter selection, they are still included in the report's results with their associated information.

Education & General Programs by Organization Unit Report

This report is designed to provide summarized Educational and General program expenditure figures for major budget units in a given fiscal year and period. Each MBU is presented with its accumulated budget, year to date E&G expenditures, and the percentage of its E&G expenditure to the budget. The results are presented with Executive, Senior Management and Major Budget Unit organization levels.

Expenses by Fund Type

This report provides summarized expenses for selected Fund Types (the source of funds) in a given fiscal year and period. Results are filtered by senior management level, major budget unit, department code or sub-department code. The fund types available for selection are educational and general, sponsored programs, FACR, auxiliary, restricted, unrestricted, financial assistance and hospital services.

FGRBDSC Budget Status Fiscal Period

The FGRBDSC Budget Status Fiscal Period is the same report that users can view in ePrint with the additional option to run at four different organization levels: major budget unit, department, sub-department and organization code. Detail includes acccount, adjusted budget, current and year to date activity, budget reservations and available balance. Fiscal year, fiscal period, and preferred organization level are required parameters for this report.

Fixed Asset Custodian List

The Fixed Asset Custodian report displays active custodians and assigned department(s) based on the organizational hierarchy selected. Results are filtered by executive level, senior management level, or major budget unit.

Gift Revenue Report Excluding 408112

This repot is a summary of year-to-date gift revenue with the exception of gifts in account 408112 (general foundation support). Users can select the fiscal year, fiscal period and organization level (MBU, department or sub-department). Report fields include: org code and description, account and account description and year-to-date activity through the selected fiscal period.

Invalid Transactions Report

This report identifies transactions that have posted to Banner with mismatched fund and program values. These values differ from the valid fund and program assigned to each account index/organization code. The report is designed to help departments monitor and correct these types of transactions. After identifying a fiscal year, users can select the organization hierarchy of senior management level, major budget unit, department or sub-department. Report results give full details of the invalid transactions including: fiscal year, Banner document number, account index, org description, fund, org code, program code, account, transaction amount, transaction date and posting period (month).

Purchase Order and Invoice Activity Detail

The Monthly Purchase Order and Invoice Activity Detail report is designed to provide transaction detail for purchase orders and invoices in a given fiscal period for all organizations. Output includes vendor, purchase order and invoice detail. Business users may run this report at four different organization levels: major budget unit, department, sub-department and organization codes. Fiscal year, posting period (month), preferred organization level and it's related code, and whether to include both purchase orders and invoices or only purchase orders are required parameters to run this report. There are two versions available, Monthly Purchase Order and Invoice Activity detail runs by organizational value (department, subdepartment). Purchase Order and Invoice Detail by Organizational YTD provides year to date transactions for an organization code (Index).

Non-Grant Organization Deficit Report

Non-Grant Organization Deficit Report is designed to present the budget deficits for organizations other than Grants. In order to run this report, business users must enter three parameters: Fiscal Year, Fiscal Period and selection type. Selection type allows users to run the report based on MBU, Department or Fiscal Manager's ID.

Open Encumbrances

The Open Encumbrances report gives detailed information on all open purchase commitments. Users may run the report by organization code, department or sub-department or major budget unit.

Personnel and Operating Expenditures Analysis

Summarized report by organization code for accumulated budget and related expenditures for personnel and operating expenditures.

Fiscal year, fiscal period, program (Educational & General, Sponsored Programs, FACR, etc.), and report criteria (MBU, department, sub-department) are necessary parameters to run this report.

Purchase Card Monitoring Report

This report shows the charges made to the index by each purchase card. The last four digits of the card number are displayed along with the vendor name and amount. This is particularly useful for verifying that PCard logs match what was charged to Banner and that the vendors seem appropriate. The report can be configured to run by MBU, department, sub-department or organization code.

Receiving Required

This handy report is used to identify purchase orders that have been matched with invoices, but require fiscal approvers to complete the receiving process in Banner. Report can be configured to run by executive level, senior management level, Major Budget Unit, Department or Sub-Department or simply by the Org Code (or Index).

Revenues and Expenditures-Organization Detail

Summarized report by organization code that includes Revenue budget, current revenues, expenditure budget and current expenditures.

Fiscal year, fiscal period, organization level (Executive to sub-department levels), and program ((Educational & General, Sponsored Programs, FACR, etc.) are necessary parameters to run this report.

Sub-department Report

This report can be considered as the summary version of Chart of Accounts report. Sub departments are presented with their codes and descriptions in the organizational hierarchy. Each sub department is presented with its all associated organization levels that are higher in the organizational hierarchy. These levels are executive, senior management, major budget unit and department.

Sources and Uses Statement by Department/Sub-department

The Sources and Uses report provides an overview of a department’s or sub-department’s sources of funding and related expenditures. Report parameters include fiscal year and fiscal period. Users will need to know the numeric code associated with their department or sub-department.

Sources (revenues) and Uses (expenditures) are presented for all funds (Operating, Overhead, Unrestricted, Restricted, Sponsored Programs, Other, Pool Accounts and Hospital Services). Revenues and expenditures are summarized by type (Gifts, Investment Income, labor, supplies, equipment, etc).

Sources and Uses Statement by MBU

This Sources and Uses report provides an overview of a major budget unit’s sources of funding and related expenditures. Report parameters include fiscal year and fiscal period. Users will need to know the numeric code associated with their major budget unit.

Sources (revenues) and Uses (expenditures) are presented for all funds (Operating, Overhead, Unrestricted, Restricted, Sponsored Programs, Other, Pool Accounts and Hospital Services). Revenues and expenditures are summarized by type (Gifts, Investment Income, labor, supplies, equipment, etc).

Sources and Uses Statement by SML

This Sources and Uses report provides an overview of a senior management level’s sources of funding and related expenditures. Report parameters include fiscal year and fiscal period. Users will need to know the numeric code associated with their senior management level.

Sources (revenues) and Uses (expenditures) are presented for all funds (Operating, Overhead, Unrestricted, Restricted, Sponsored Programs, Other, Pool Accounts and Hospital Services). Revenues and expenditures are summarized by type (Gifts, Investment Income, labor, supplies, equipment, etc).

Transaction Detail Report

Transaction detail report is designed to provide detail transaction information in a given fiscal period for all organizations. Transactions are presented chronologically with their description, amounts, associated rule class and document information, related organization code, organization description, account and account description. Business users may run this report at three different organization levels. These levels are: Major budget unit, department and sub-department.

Fiscal year, posting period (month), preferred organization level and its related code, and range for associated accounts (to see whether the transaction is associated with an expenditure, revenue or personnel costs accounts) are necessary parameters to run this report.